We are a hit!

Newly relaunched Retail Risk – London and the Gala Dinner attracts record numbers. Click the button below to see the gallery…

To see the gallery, click HERE…

GUEST ARTICLE BY DAN HARDY

What do we mean by risk?

Our jet-lagged writer explains why it’s time for retailers to define what they really mean when they talk about “risk”

Is it just me, or does jet lag get worse as you get older?

If you’ve been following my articles over the last few weeks, you’ll know I recently embarked on a three-week tour of New Zealand with my wife and nine-year-old daughter, Martha, following the England women’s cricket team on tour.

I can genuinely say it was the best holiday I’ve ever had; I loved every minute of it. The jet lag on the other hand? Not so much…

We’ve been home for a week now and I’m still waking up at 3am.

Wide awake and staring at the ceiling, I elected to put my very early starts to good use with a few very early morning runs. If nothing else, my neighbour is left open mouthed at my extreme commitment to physical fitness as I return home, an 8K later, at 6am! Shame it won’t last!

My body clock might be all over the place, but of course the show must go on…

After reuniting with our excitable spaniel Izzy (so excited, she wet herself!), and waving the folks off from house sitting duties to join yet another cruise (they were practically putting on their life jackets as we pulled into the drive), I was straight back to work.

With the Retail Risk conference scheduled for Thursday, it was full steam ahead as my team and I finalised preparations for the big day.

Of course, planning for the event had been in motion for several months. To be honest, from the moment I accepted the job as Group MD at ASEL, I had known that the conference would play an important role in communicating our new strategy and company values.

For me, a key part of our mission is to get people to step back and really think about what they mean by ‘risk.’ It’s a term frequently bandied about but, how many retailers can actually define what it means for their organisation on a day-to-day basis?

After all, everyone’s interpretation is different. What constitutes a ‘significant loss’ or ‘tolerable level of risk’ for one business, won’t be the same as for another.

This is why I believe retailers must first nail down these definitions before developing a bespoke risk model that aligns with their brand’s specific risk acceptance policies. Sounds obvious right? Maybe so, but as I explained in my talk at Retail Risk, you’d be surprised by how few retailers are actually doing it.

With the support of my exceptionally clever colleagues, Hannah Powell and Tyrone Alleyne, I also used my time on the main stage to showcase a risk model in action…

We used sample data and live feeds to demonstrate, in real-time, how we gather intelligence and monitor metrics to help retailers better manage their security – something that’s never been done at Retail Risk before.

We then welcomed people to come to our stand and test out the technology for themselves. And if that wasn’t enough, we even invited delegates to see what happened when they took an item from our smart shelving. Let’s just say, they might have had a visit from our robot!

The last few weeks have been a real whirlwind. But it was great to be back and meeting so many retailers this week – even if the jet lag is still taking its toll!

Dan Hardy

Group Managing Director

ASEL

GUEST ARTICLE BY FRANK HAVELKA

“We’re a peace-loving nation… There’s no place for violent extremism.”

Recent events in Sydney are grim reminders of the importance of risk management in public spaces…

On Saturday, 40 year old Joel Cauchi sent the crowded Westfield Bondi Junction complex into panic when he began stabbing people with a long blade.

Five of the six people who died were women. Several others, including a baby, were injured; tragically her mother died of stab wounds received trying to protect her baby girl.

Just a few days later and another stabbing, this time in a Sydney church, was met with violent riots outside. Prime Minister Anthony Albanese convened an emergency meeting of national security agencies, calling the attack “disturbing.”

The Premier commented “We’re a peace-loving nation… There’s no place for violent extremism.” Trying to quell further violence, he urged that people “not take the law into their own hands.” Suddenly the police were being turned on by the very community they seek to protect.

Both shocking events are reminders of the need for security in public spaces. And to me, the violent response of the crowds to the Church stabbing, with police officers badly injured, police vehicles destroyed and paramedics put in fear of their lives, also reminds me that we seem to live in a more volatile world than ever before…

Travelling in for Retail Risk – London, these recent events served to further heighten my awareness of the need to redouble our efforts in the field of risk management. Not just for the sake of retailers, who were our obvious focus at this conference, but for all stakeholders.

I am delighted to have participated in the Retail Crime Advisory Group where retailers, the police and key vendors to the industry are working together to try to constantly improve collaboration; to share knowledge for the common good and to respond to the ever changing threats out there. In my experience, there is nothing like RCAG elsewhere. It is a huge asset for the UK.

Meeting new threats is something that we at Vix Vizion are continually discussing and designing solutions for…

We have for some time been looking at enhancing Face Recognition Technology (“FRT”) to provide identification of more than just people. We have been looking at objects too.

We have been working on software that will identify drawn knives, guns and other weapons to bring to an operator’s attention a potential threat at the earliest opportunity. Gaining those vital seconds could save a life, or lives, by providing the earliest possible warning.

More than that, we have also been involved in work around the reading of emotions with FRT.

Originally the concept was to use FRT to read the physical signs of distress in potential heart attack victims. Not just the sort of optics that would attract the attention of another person, but the myriad of changes in appearance that indicate distress and a potential heart attack. This would, for example, help hospitals or care homes to react faster and intervene at the earliest possible opportunity.

In the case of public spaces, this emotionally aware FRT might equally be used to identify people who are angry and aggressive. Spotting someone in a heightened emotional state could lead to de-escalation measures being deployed quicker. That could be an address over a public address system, or a security officer being deployed… or both. Maybe a warning to other shoppers of the perceived danger.

For now, I think it is worth thinking about the significant responsibility incumbent upon all of us in the industry to keep people safe on a daily basis, and to redouble our efforts to meet emerging threats like those which have so tragically manifested themselves this week in my hometown…

Frank Havelka

Business Development Manager

Vix Vizion

GUEST ARTICLE BY DAVID DALTON

Can’t wait to meet you… Just let me find my suit jacket first!

Our writer reflects on the realities of moving house and living out of boxes in the run-up to Retail Risk – London…

Moving house is damned stressful. And I should know.

Having moved four times in the last six years, you’d think I’d be an expert by now!

But with our latest move, which has been beset by delays (our original March moving date turned out to be highly ‘mobile’ itself, and has been pushed back to mid-May), it’s fair to say my stress levels are pretty high.

Waiting to get a final completion date is nerve-wracking enough. But we’ve been living out of boxes and temporary wardrobes, with our three kids, for weeks now. And let me tell you – it’s not easy!

Often, I’ve had to rifle through the mountain of boxes to find something. And the ‘something’ is, it seems, inevitably buried right at the bottom of the last box you look in. Joy!

As much as I welcomed last weekend’s Spring sunshine, it did mean an expedition through a mountain range of packed boxes and associated paraphernalia to retrieve the lawn mower from the back of the garage. Not an easy feat!

And as I prepared for the Retail Risk conference earlier this week, the reality of our current living situation hit home once again…

Exactly where, I asked myself, in towering sea of cardboard and bubble wrap, had I put my shirt and suit jacket? After all, the joys of home working mean I’ve largely been living in t-shirts.

I eventually located said items, creased and crumpled, at the bottom of one of the suitcases (I had already looked through all the boxes first!).

Well, at least I knew where the clothes iron was – but only because my son had managed to melt his football shirt with it the day before! Now I just had to hope the hotel had a friendly concierge to press the suit… Or, more likely, an ironing board I could use to try and do it myself.

Despite my slightly chaotic scramble to pull together a suitable outfit, I’m pleased to say the conference itself went off without a hitch. In this post-covid era, it was great to meet retailers and contacts face-to-face. And, for me, that’s one of the main draws of Retail Risk.

With so much of our day-to-day communication now done on Teams, these conferences are a now relatively rare opportunity for vendors, retailers and their respective teams to come together under one roof. Video conferencing has its perks, but nothing beats in-person interaction.

With key players all in one room, it’s also the perfect chance to get sign-off on important projects. What can take months of planning, copious emails and careful diary management can be achieved in just one day. A huge win for both vendors and retailers.

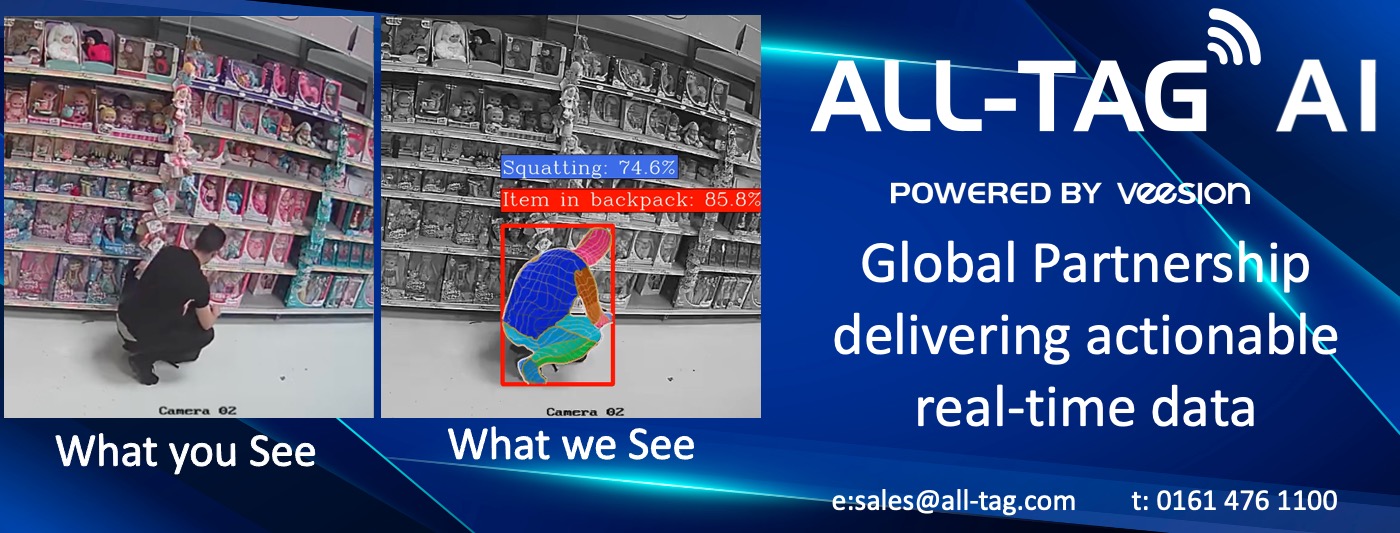

If you attended our round table discussion on the day, you’ll know communication is central to our ethos at All-Tag.

As part of our holistic approach, we commit to regularly meeting retailers wherever they want to meet – whether it’s head office, the local coffee shop, or a conference. It’s just one of the ways we strive to serve our customers better.

Communication is so important, to understand what really matters in a relationship. And with that in mind, I think it is time to call the estate agents for a frank exchange about the ‘hassle free’ service they promised to deliver!

All-Tag Europe is a leading manufacturer of Electronic Article Surveillance (EAS) products and services.

David Dalton

Sales Director EMEA

All-Tag Europe

NEWS ARCHIVE

It was a real ‘pinch yourself’ moment.

There I stood, in the iconic Churchill War Rooms – the building from where the British Government directed its forces during the Second World War.

The day was not just going to be memorable for the venue. More than that. I was preparing to give my first thought leadership address as ASEL Group Managing Director… Just a few days in post, it had been a sudden and unexpected whirlwind of activity that brought me to this place.

To fill my predecessor’s departure from Argentbright Security Europe Ltd, I had been approached and spent much time contemplating the role of Group Managing Director!

At the time, I was Global Head of Security for TUI; bestriding the globe making decisions that would affect millions of tourists.

Consulting with governments, conferring with local and international security services and armed forces, I worked at the highest levels to meet the tourism challenges thrown up by Ukraine and the Middle East, not to mention the myriad of other regions with potential bear traps for tourists.

Responsible for a massive estate incorporating everything from hotels and planes to buses and cruise ships, it had to be one of the best jobs in risk management. Why would I change? I had, after all, only left 18 months ago!

But Frank Argentbright is a persuasive man. After all, you don’t build a multi-billion dollar security company from scratch without a talent for persuasion! He and his team managed every concern with pace. With apologies, he “will never surrender!” And so, it began.

Frank and his team launched a recruitment offensive. They met with me to explain what they wanted, where they were heading and how they wanted me on the journey. They got my wife and daughter on board. Hell! Even Izzy, my spaniel, soon greeted them like old friends instead of barking ferociously and jumping all over them!

And once I fully understood the seismic shift they had planned for the provision of security in the UK and Europe,I knew I had to be a part of it. A grand finale to my longer-than-I-care-to-remember career. A fitting end, before someone shoves this old geezer through the door and I feel the thwack of it as it hits me in the back, on my way to a quieter life of wine, food and amateur sports coaching!

Now, here where one great leader had once inspired his team, it was my chance to inspire mine. Different enemy. Different times. Same goal… to win.

Surrounded by memorabilia curated from Britain’s finest hour, I felt the weight of history upon me, adding to my pre-presentation nerves. But then it dawned on me. Where better to motivate people to drive change than the very place where Churchill plotted Britain’s path to victory?

With the formalities out of the way, I asked team members to reflect on their own achievements. As I studied the room and mulled over the various success stories, I realised just how far we’ve come – as an industry and as a society.

Here we were, talking about how to manage crime with facial recognition and biometrics, when Churchill won WW2 in the room next door with little more than a chalk board and a map!

Today, I do not even own a chalk board. However, I do have an impressive suite of data that can tell me, in real-time, what’s happening in 3,000 locations, what resources are being used and, critically, will be needed.

Since taking over as MD, I have begun a mission to make ASEL a people-centric organisation. For me that means understanding my team and inspiring them to be the best they can be. I want to encourage a culture where bold decisions are valued and where we embrace and learn from all outcomes, whether successful or not.

The fate of the nation might not be in my hands, but my experience in the Churchill War Rooms was a stark reminder of the power of people being mobilised to action in times of change.

I’m no Churchill, but I’d like to think my team and I share the same indomitable spirit as those who helped us secure that unlikely victory all those years ago.

Dan Hardy is Managing Director of ASEL

ASEL will be exhibiting at Retail Risk – London. For details and to register click HERE…

As a Cabinet Minister, Chris Philp is always going to be under incredible scrutiny.

And of course, you cannot please all of the people all of the time – although something garnering at least some semblance of approval every now and again shouldn’t be too much to ask, should it?

A controversial figure, when Mr Philp speaks with them in closed session, following his main stage appearance at Retail Risk – London this April, I wonder what solace he will offer beleaguered retailers? What innovative thinking or even simple, practical steps will the Minister outline to help fight ORC? Let’s hope he grasps the opportunity to listen and help.

In the past Mr Philp has received significant criticism from John Grace who described him as “No 10’s useful idiot” the Guardian reporter went on to write that “Men such as Philp earn their money by going out of their way to make sure they know nothing.”

Memorably, the Minister pledged in September ’23 that every shoplifting offence will be investigated by the police. Inevitably there followed the suggestion of a disconnect between the Minister and the reality of the possible – especially in retail settings! Although to be fair, “reality” for retailers is itself a moveable feast…

Now is the time for Mr Philp to prove John Grace wrong and step up to help retailers across the country.

Recently, when conducting a store visit to a supermarket, I was informed that the previous evening the site had suffered a burglary. It wasn’t the usual cosmetics, razor blades or spirits that had been stolen. No. Instead washing powder and fabric conditioner had been the focus of the attack.

With retailers now facing crime on products that haven’t traditionally been targeted, perhaps because ORC is deriving a massive income from the resale of stolen goods, then something more than fine words from government are needed.

With the cost of living crisis, it is easy to imagine how some people might feel compelled to commit crime in order to support themselves and their families, and how more people are willing to buy stolen products to make family budgets go further. ‘Though one thing is for sure. Whether people are turning to stealing or receiving stolen goods, retailers are increasingly up against it.

All-Tag have a range of products specifically targeting the area of resale of stolen goods (as opposed to stealing for own use) to make it less appealing for ORC by reducing the number of markets, and so prices, where resale is possible.

All-Tag’s Q-Guard, Q-Guard Lite and Evidence Labels try to eliminate or reduce the shoplifters’ ability to re-sell stolen products. By permanently ‘marking’ them with a retailer name or message, it shows that they are intended for sale in certain stores. So, if found for sale outside of these stores, questions are inevitably going to be asked about the individual or organisation trying to sell them.

Any attempt to remove this protection from products will result in damage to the packaging. And this damage will itself significantly reduce or remove the potential resale value.

If stolen goods are recovered with retailer branding, they can be re-patriated to the appropriate retailer and potentially re-distributed into supply chains, so recovering the revenue and margin or to assist law enforcement by identifying the victim and therefore making prosecutions easier.

Plus these anti ORC products are quick and easy to apply and also there is no “attach, detach and recycle back to store” process saving a huge amount of instore labour resource. This also means that all of these products are Self Check Out ready! What’s more as you would expect, they are fully customisable to exact retailer requirements.

The overlay nature of these All-Tag anti ORC products means we are protecting the LP detection asset, be it an RF, AM or RFID label. This makes it much harder for offenders to remove these essential labels and provides a very high level of deterrent.

I don’t know what Chris Philp is going to be saying at Retail Risk, or indeed what he will be doing to help retailers fight ORC. However, I am prepared to bet that it is not going to be anything as practical or effective as what we are already doing at All-Tag!

Tim Moore is Managing Director of All-Tag in the UK – Trusted source for EAS since 1992 www.all-tag.com

All-Tag will be exhibiting at Retail Risk – London. For details and to register click HERE…

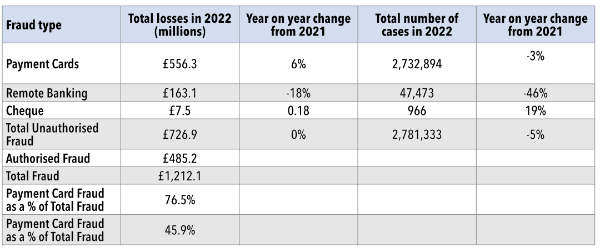

Uswitch credit card experts have released a fraud report, detailing the average losses Brits have incurred due to credit card fraud, banking fraud and more in the past three years.

This data is based on police figures and the UK finance report.

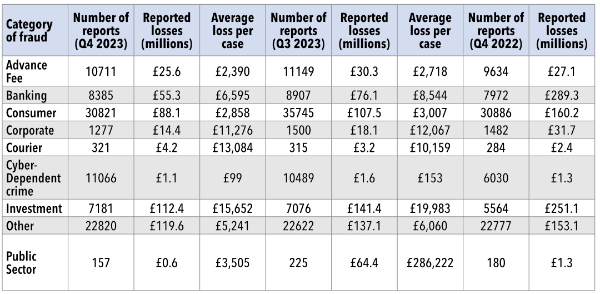

Counting The Cost of Fraud: Scammers Stole Over £421 Million Last Quarter!

- Uswitch analysis found that scammers stole £422 million last quarter, from 92,739 reported cases of fraud

- Brits lost £1,212 million to credit card fraud in 2022, down 5% from the previous year

- Over three quarters (76%) of fraud was credit card fraud

- Data suggests £26.1 million was lost through fraudulent ATM withdrawals

- The country where fraud on UK credit cards happens most is Ireland, followed by the USA

The new credit card fraud report from Uswitch analyses police figures[1] and the UK Finance report[2] to reveal where in the UK has seen the biggest rise in credit card fraud and cybercrime, plus which are the most common types.

Cybercrime has dominated the headlines over the past two years as fraudsters are becoming more sophisticated in their attacks. In some cases, successful criminals are stealing hundreds of thousands of pounds in just a single intrusion.

2022 Credit Card Fraud figures

Salman Haqqi, Uswitch credit cards expert said: “Cybercrime has inflicted nearly £2.5 billion in losses on Britons over the past year, highlighting the importance of safeguarding our online data and exercising heightened caution during digital transactions.

“Using a credit card for online purchases provides an added layer of security. With purchases ranging from £100 to £30,000, even partial payment using a credit card entitles consumers to enhanced protection under Section 75 of the Consumer Credit Act. This provision enables reimbursement from the credit card issuer if the vendor becomes unresponsive or disputes arise.

“Maintaining up-to-date antivirus software across your devices — be it computers, phones, or tablets — serves as a proactive defence against cyber threats.

“Moreover, it’s crucial to remember that reputable institutions like banks never solicit sensitive information such as credit card details via phone or email.

“In the unfortunate event of monetary loss, prompt communication with your bank is paramount.”

What were the most common cases of credit card crime in the UK in 2023/24?

Who has been the most impacted by credit card crime?

Those aged 30-39 were targeted the most by fraud and cyber crimes in Q4 of 2023, with those aged 20-29 not far behind. Individuals younger than 70 were most commonly victims of online shopping and auctions fraud (excluding uncategorised crimes).

Older age groups more commonly experienced crimes in the categories of computer software service fraud, advance fee fraud, cheque/card fraud, and door to door sales fraud.

Computer software service fraud involves criminals posing as legitimate software companies, such as Microsoft, calling you to tell you there’s a problem with your computer in order to gain access to your private information or hold you to ransom and commit fraud.

Advance fee fraud is when fraudsters target victims to make advance or upfront payments for goods, services and/or financial gains that do not materialise.

Where have crimes increased the most quarter to quarter

The report also looked into police force figures to understand which parts of the UK have experienced a significant change in fraud figures.

In the last quarter of 2023, Bedfordshire saw the biggest rise in the number of reported crimes for a mainland UK police force – figures rose by almost 25% – with the total value of losses reaching nearing £4 million. City of London and Police Scotland were the only other forces that saw increases in Q4 (9% and 6% respectively).

Contact us

Retail Knowledge Services DMCC

AG Tower

Jumeirah Lakes Towers

Dubai

UAE

Telephone

London: +44 (0) 207 100 3 999

Sydney: +61 (0) 2 8310 5744

New York: +1 646 396 0450

Email: [email protected]

© Retail Knowledge 2023

Our conferences

Retail Risk – Sydney

Retail Risk – London

Retail Risk – Melbourne

Retail Risk – Cape Town

Retail Risk – Leicester

The trademarks Retail Risk, Gala Dinner and the Fraud Awards are owned and licensed for use by Really Effective Marketing Ltd. All rights reserved.